When Audio Proved Video Wrong

Audio Intelligence Report | December 2025

The end-of-year is known best as a time to wrap up loose ends, set new targets for the year ahead, and focus on the upcoming holidays with families. Yet 2025 ended with a month rich in insights about the future direction of podcasts, radio, and audiobooks.

To ensure that so much value and direction is not forgotten in the New Year haze, here’s your strategic breakdown of the key intelligence shared in December 2025.

The ROI Reality Check: Audio Beats Video

For most of 2025, the industry obsession was YouTube simulcasting. Yet the year ended as a reality check for the “Video Killed the Radio Star” narrative. The year-end revealed a critical bifurcation: Video is winning the war for attention, but Audio is winning the war for conversion.

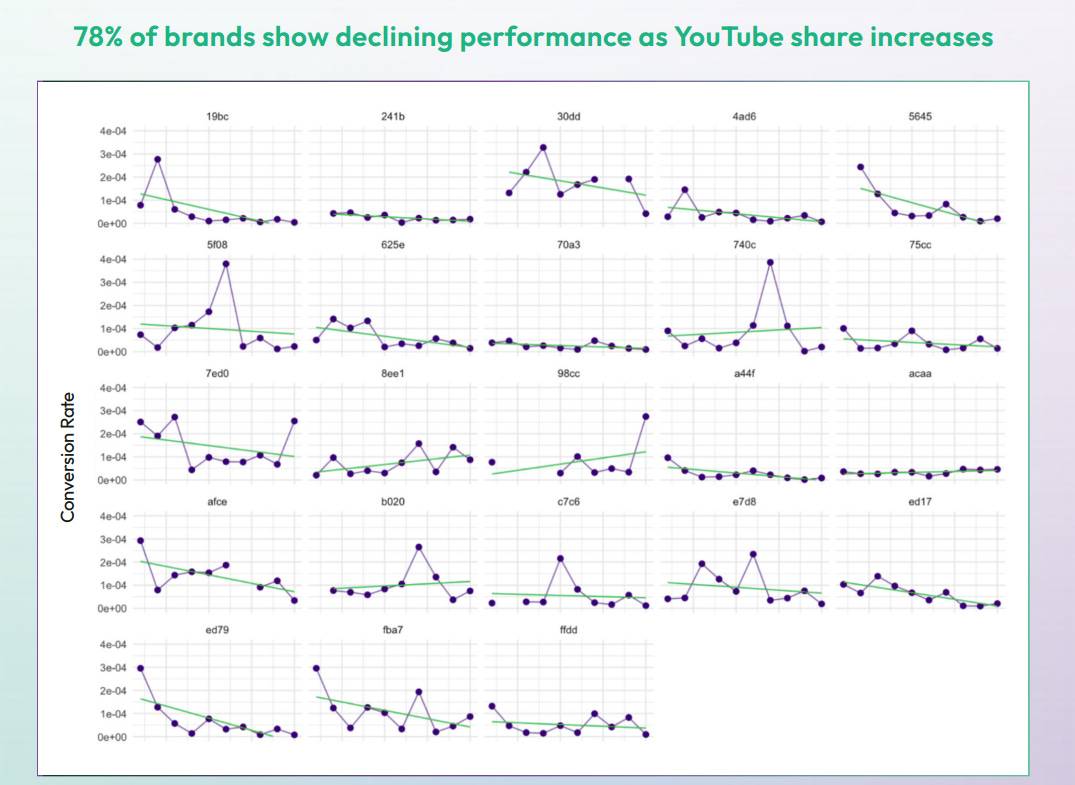

A landmark white paper released by Oxford Road and Podscribe challenged the prevailing video narrative. Their analysis of over a thousand campaigns reveals that audio-only RSS ads convert 25% better than YouTube video ads for driving website purchases (link for White Paper).

Why this matters: This is the counter-narrative performance marketers have been waiting for. While YouTube offers massive reach (with 47% of podcast consumers saying they listen more than watch on the platform), the “lean-back” nature of video consumption appears to generate less immediate commercial action than the “lean-in” intimacy of audio.

If you are optimising for brand awareness, video is essential. If you are optimising for Cost Per Acquisition (CPA), the data suggests you cannot abandon pure audio.

The “OG” Moat: Trust Cannot Be Algorithmed

2025 saw a further uptick in new celebrity podcast launches. Yet data underlines there’s no fast track to success. “Old Guard” (OG) podcasts are eating the newcomers’ lunch. Oxford Road’s “ORBIT” analysis found that podcasts launched before March 2020 (”OGs”) carry a 12% efficiency premium over newer shows,.

Contrast to Past Context: Throughout 2025, we saw a frenzy of expensive celebrity deals. However, this December data suggests that time in market is a metric that cannot be hacked. Trust compounds over years, not weeks and months. The “OG” shows have built deep-seated relational capital that translates into higher conversion rates, proving that while new shows can buy reach, they cannot easily buy the kind of loyalty that drives sales.

The “Long-Form” Counter-Narrative

YouTube’s Culture & Trends reports continue to provide some of the richest country-level insights into what is actually working. Back in September, we highlighted “Creative Maximalism“ as the defining aesthetic of 2025—a chaotic, high-stimulus visual language layered with complex lore. We saw this in viral hits like “Skibidi Toilet” and the global phenomenon of “Italian Brainrot,” an absurdist universe that generated over 450,000 uploads in 2025 alone.

However, the latest year-end data adds a critical counter-narrative: the myth that short-form video is killing attention spans is false. In the UK specifically, YouTube reports a surge in long-form video consumption, citing creators like Gary’s Economics (political deep dives) and Niko Omilana (entertainment) who regularly post videos exceeding 30 to 40 minutes that perform exceptionally well.

Strategic Implication: This aligns perfectly with our “Living Room Takeover” data. Audiences will give you 60 minutes of attention on a TV screen, but only if the content merits the format. The audience is craving depth, whether that’s an hour-long audio documentary or a 45-minute YouTube video essay on economics. The middle ground—short, shallow content—is where engagement goes to die.

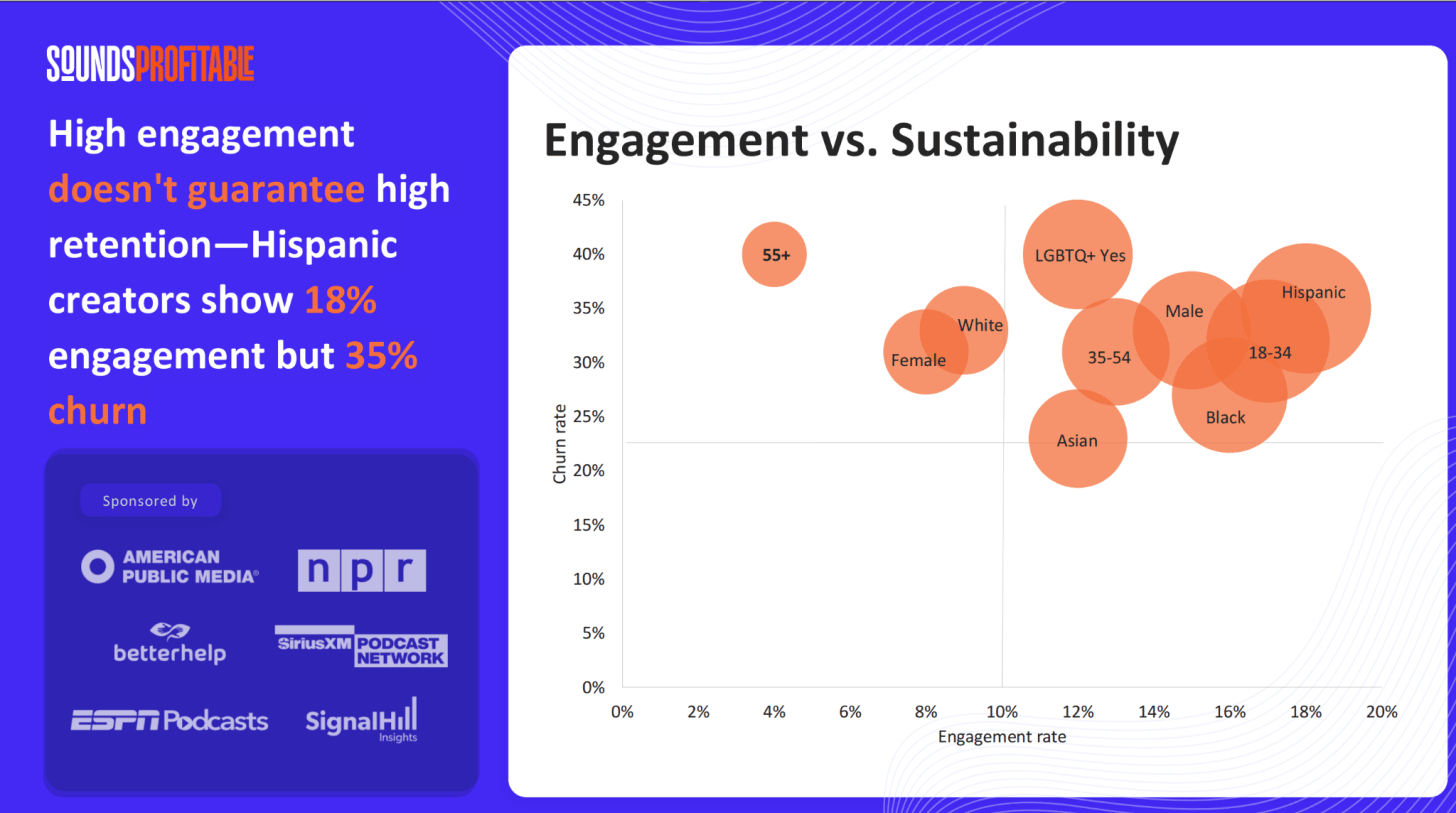

The Creator Pipeline Problem: It’s Entry, Not Churn

Following Sounds Profitable release of “The Creators 2025,” Tom Webster highlighted a critical structural flaw in the podcast ecosystem: the gender gap is an entry problem, not a commitment problem. Only 8% of women in the podcast consumer base are active creators, compared to 15% of men. However, once women start, their retention rate (69%) is ever so slightly higher than men’s (67%).

Contrast to Past Context: This connects directly to the USC Annenberg report we highlighted in November, which found that women of colour host only 7% of top podcasts. We now have the “why” behind that stat. It is not that diverse creators are quitting; it is that the barriers to entry, perhaps exacerbated by the expensive pressure to pivot to video, are preventing them from starting. For the industry, this is the wake-up call: we don’t need to fix “podfade“ for women; we need to fix the on-ramp.

The Creator Economy Ad Spend Hits $37 Billion: The “Institutional Grade” Era

The headline number from December is impossible to ignore: The IAB projects that U.S. creator ad spend will climb to $37 billion in 2025, a 26% increase that is growing four times faster than the broader media industry. This isn’t just a trend, it’s more like a takeover.

Brands are categorising creators alongside CTV and search — as essential performance engines rather than just experimental “social extensions”. For audio creators specifically, this means podcast sponsorship is no longer competing with ‘experimental social media budgets’ but with institutional media buying at scale - raising both opportunity size and performance expectations.

Significance & Context: This projection validates the massive capital injections announced in October when Steven Bartlett’s Steven.com closed a funding round at a $425 million valuation. This was the specific, tangible proof of the IAB’s macro trend. We are witnessing the industrialisation of influence. Bartlett isn’t just a podcaster; he’s building what he calls the “Disney of the creator economy,” blending media, technology (FlightCast), and venture capital. The IAB report confirms that the market has moved beyond individual sponsorships to scalable, institutional-grade media buying.

The Living Room Takeover: 700 Million Hours

YouTube reported that 700 million hours of podcast content were consumed on TV screens in October. While some analysts note this is still a small fraction of YouTube’s total TV streaming, the trajectory is undeniable. Podcasting is no longer just a “commuter” medium; it is becoming the new “late-night TV“.

Significance: This reinforces the dual pathways theme we’ve tracked all year. While audio drives conversion, this data confirms that video drives brand time. When consumption moves to the living room TV, the context shifts from intimate information-gathering to communal entertainment. Creators must now program for two distinct environments: the intimacy of the earbuds (for sales) and the spectacle of the 65-inch screen (for brand awareness).

The Audiobook Wars: Spectacle vs. Scale

For years, the industry questioned whether Spotify’s “all-you-can-eat” access model would devalue audiobooks. The December data offers a definitive answer: The streaming model isn’t killing the industry; it’s expanding it.

We are witnessing a (further) fascinating bifurcation in strategy between the two market leaders.

Audible is doubling down on “Audio Spectacle,” leveraging its deep pockets to create Hollywood-level productions like the new full-cast Harry Potter to entrench its premium subscriber base.

Spotify, conversely, is playing a game of “Market Expansion.” By frictionlessly inserting audiobooks into the feeds of millions of existing music and podcast listeners, they are converting non-readers into listeners. The data validates this: Spotify reported a 37% year-over-year increase in listening hours, with over half of their audiobook audience under the age of 35.

Significance: This proves that the “streaming tsunami” predicted back in 2020 has arrived. Publishers who once feared streaming are now reporting double-digit growth driven specifically by Spotify. Furthermore, the content fuelling this growth is distinct: Spotify’s year-end charts were dominated not by business biographies, but by “Romantasy” titles like Fourth Wing and A Court of Thorns and Roses. This confirms that when you lower the friction of discovery, younger, fiction-hungry audiences will devour long-form audio content at unprecedented rates.

The Global Planning Map: Why You Need a Passport for Growth

For years, “global” podcast strategy mostly meant “the US and the UK.” A new study from NumberEight, Barometer, AdsWizz, and Sounds Profitable fundamentally challenges that laziness. The report identifies that while the US leads in spend, consumption in markets like France, Germany, and Australia is outpacing investment, representing an immediate arbitrage opportunity for buyers seeking incremental reach.

Significance: This moves the industry away from generic demographics toward “market-specific listener personas.” For instance, in the US, the data highlights “Holiday & Travel Seniors,” while in France, it points to “Eco-Minded Young Adults”. This granularity is essential for 2026 planning. It signals that the “one-size-fits-all” RSS feed strategy is dead; smart money will now treat audio not as a single global channel, but as a collection of distinct cultural markets requiring localised targeting.

The Key Takeaway

As we head into 2026, the data indicates a “ barbell” strategy is winning:

High-Octane Video: Use YouTube and “maximalist” clips for reach and discovery.

High-Trust Audio: Drive the audience to RSS feeds for conversion and retention, where the ROI is significantly higher.

The middle ground—mediocre video simulcasts with no strategy—is the kill zone. Choose your lane or drive in both, but know why you are in each.

What This Means For Your 2026 Strategy

If you’re optimising for performance marketing, don’t abandon RSS feeds for YouTube simulcasts

If you’re a legacy show, your “OG” status is a moat worth defending and amplifying

If you’re addressing the creator gender gap, focus resources on entry barriers, not retention programs

If you're budgeting for 2026, the $37B creator economy means podcasts are now judged against institutional media standards - you'll need to prove both reach and conversion, not just one or the other

Have thoughts on December’s intelligence? Reply or add a comment. I read every response.

Another great newsletter full of insights!